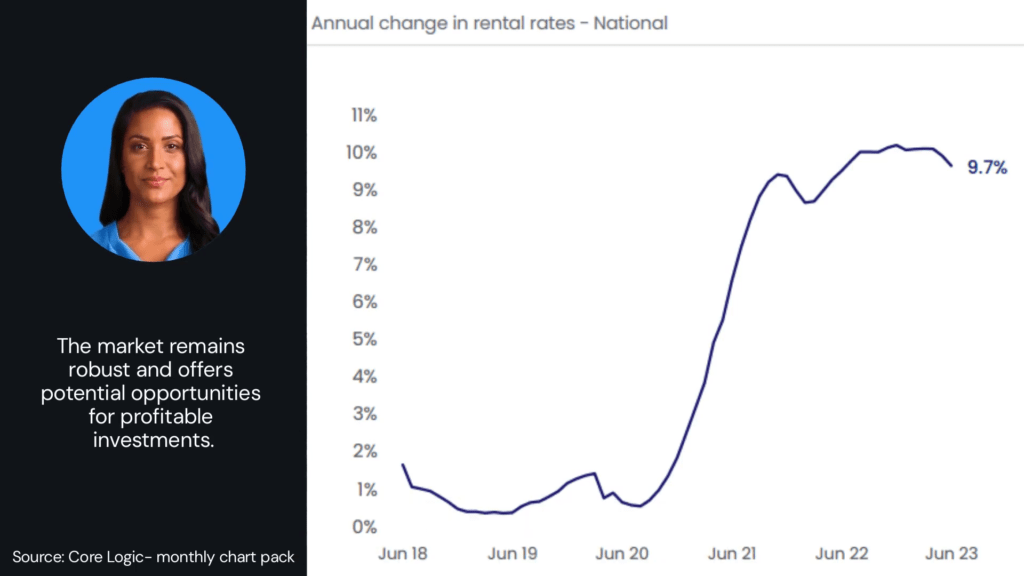

Keep up to date with the market.

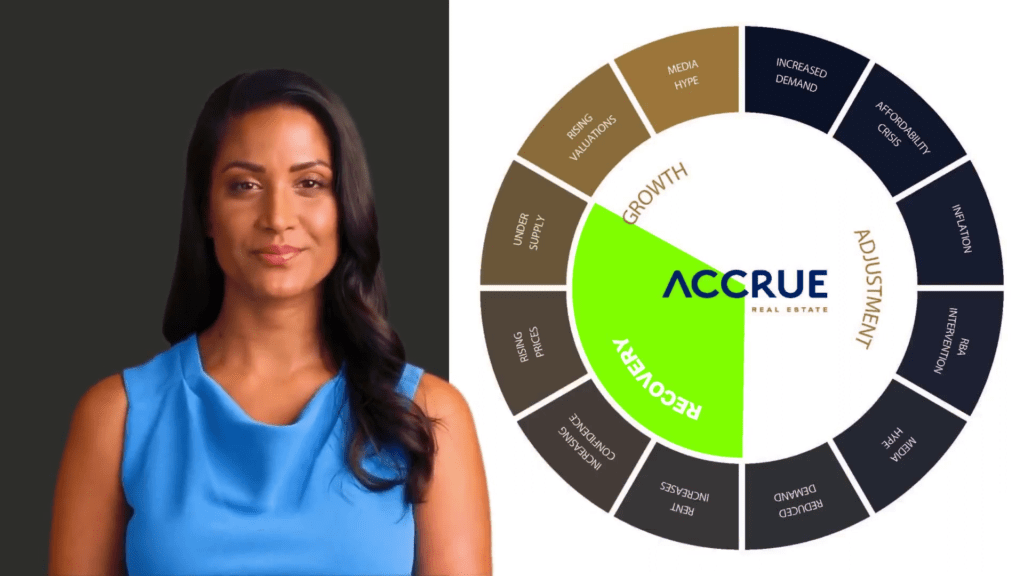

Introducing our Accrue Monthly Report, designed to provide valuable insights and guidance on the ever-evolving Australian Property Market.

GET IN TOUCH

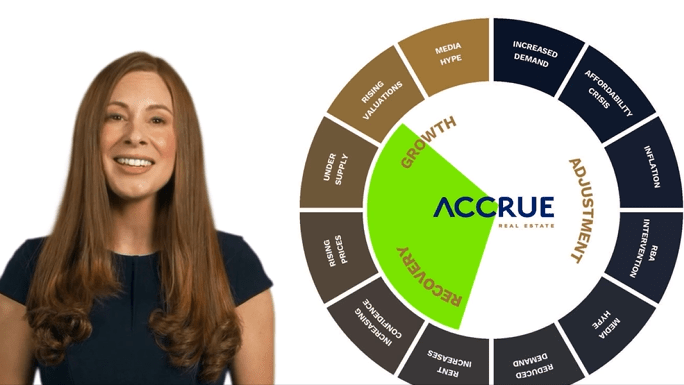

Together, let’s unlock the potential of the property market and seize exciting opportunities for success.