Published

February 2, 2022

Publisher

Accrue Real Estate

Author

Michelle Viney

Making your mark in 2022

Don’t you love the opportunity each new year delivers? It’s a chance to assess how the previous 12-months unfolded and apply those learnings to the coming year. A moment to gain clarity and refocus on the horizon.

Your end goal as an investor should be this – come December 2022, you’ll look back without regret, satisfied that the decisions you made this year advanced your plans toward financial security.

So, what can you do to make that happen?

Here’s my guide on what to expect from markets, and how you can make the best of 2022.

2021 in Review – our hit predictions

I want to first look back at my predictions from the January 2021 issue of Accrue Magazine which, I’m pleased to say, were spot on.

My overall position 12 months ago was that 2021 would be the year of the investor. There would be a wealth of opportunity and plenty of upsides to enjoy.

One year ago, it felt like we were emerging from the pandemic slumber. International vaccination programs were underway, and their use in Australia was imminent. Aussies were still utilising government assistance to shore up their finances. Combine that with reduced discretionary household spending (i.e., no travel or big nights out) and you saw the population accumulate plenty of savings.

Also, 2020 had taught us a lesson about how the earth could shift at a moment’s notice. Most of us were given a wakeup call – you needed to make plans and act on your own behalf. As a result, we saw people take responsibility for their own financial security and real estate was the ideal investment option.

We noted back In January 2021 that markets had already begun to improve. The supply of property had remained tight throughout the year, and this was likely to continue. There was also widespread expectation interest rates would remain low.

To me, this added up to an excellent opportunity for capital gains. In fact, I said at the time:

“So, what does this tell us about the 2021 market?

It says that property prices on the whole will not only hold firm, but likely rise so long as demand and supply remain weighted in favour of sellers – and I fully expect that to happen.”

Given this track record, I feel confident in analysing 2022.

So, let’s break down the components that are set to drive the market, and discuss what to expect over the next 12-months or so.

The pandemic influence

The pandemic will remain prominent in our decisions this year, but its relevance will fade in time.

As at the time of writing we are sitting in a somewhat precarious position. State’s borders are open for the most part. Lockdowns are a thing of the past, but the Omicron variant is running rampant through the east-coast and central populations. At this stage is appears to be a less severe form of COVID, but we’re yet to feel it’s full fallout.

On the plus side, most states are exceeding 90 per cent first vaccine doses and are very close to reaching the same milestone with second jabs. In fact, a huge proportion of the population are now rolling up for a booster.

Health advice suggests that we will see case numbers rise quickly for some weeks, but there is a good chance they will come back just as fast. In addition, there’s evidence that hospitalisations and serious outcomes will be proportionally lower than with previous variants.

While I stress that I’m in no way qualified to provide medical opinion, the articles I’ve read paint a picture of a hope. We are going into an endemic stage of the virus with new prevention and treatment options being continuously developed.

In short, while the virus will be with us for some time, its impact will diminish during 2022. I believe that by the end of this year, COVID will be a lower-rung concern for most investors.

Confidence and economic outlook

One of the most striking things about finance and property is that performance is influenced by the collective ‘gut feeling’ we have about the future. When stakeholders are confident, they’re happy to speculate. But turn that confidence into trepidation, and things can quickly spiral down.

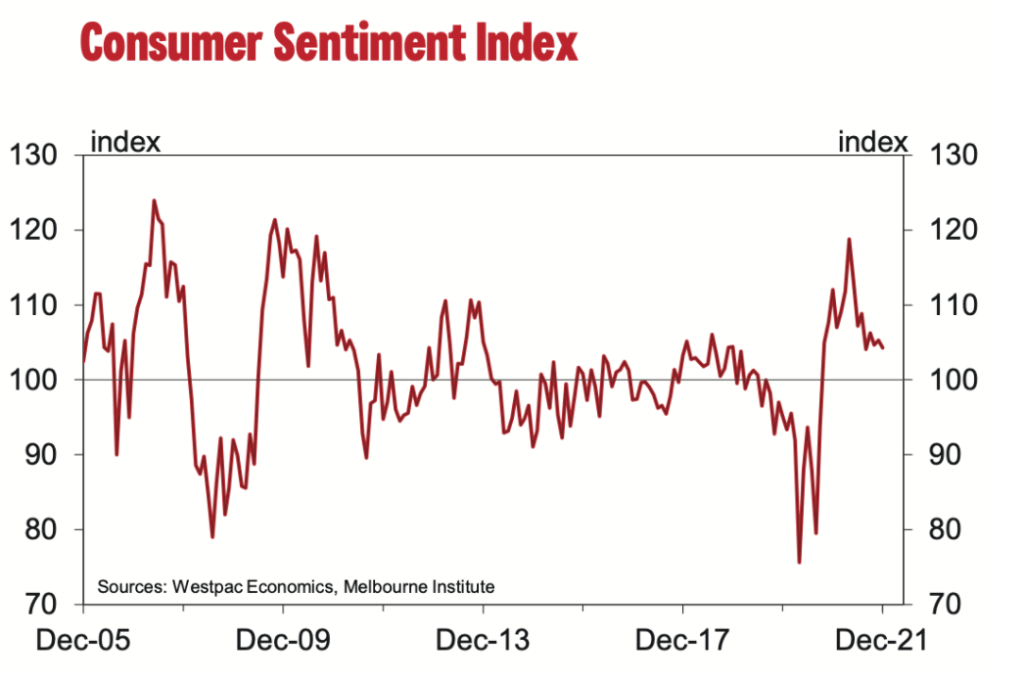

A great source for measuring our economic outlook is the Westpac-Melbourne Institute Index of Consumer Sentiment. The most recent release to December 2021 revealed confidence remains positive, although it has subdued as the year progressed.

The index fell by 1.0 per cent to 104.3 in December 2021 from 105.3 in November 2021. It’s also lower than back in December 2020 when the index was at 112.

According to Westpac’s chief economist, Bill Evans, a state-by-state breakdown saw those jurisdictions hardest hit by lockdowns (i.e., Victoria and New South Wales) as the ones lacking the most optimism.

But here’s my take – while optimism has flagged a little, it remains positive. Given current uncertainty surrounding the pandemic, this is a sign of resilience.

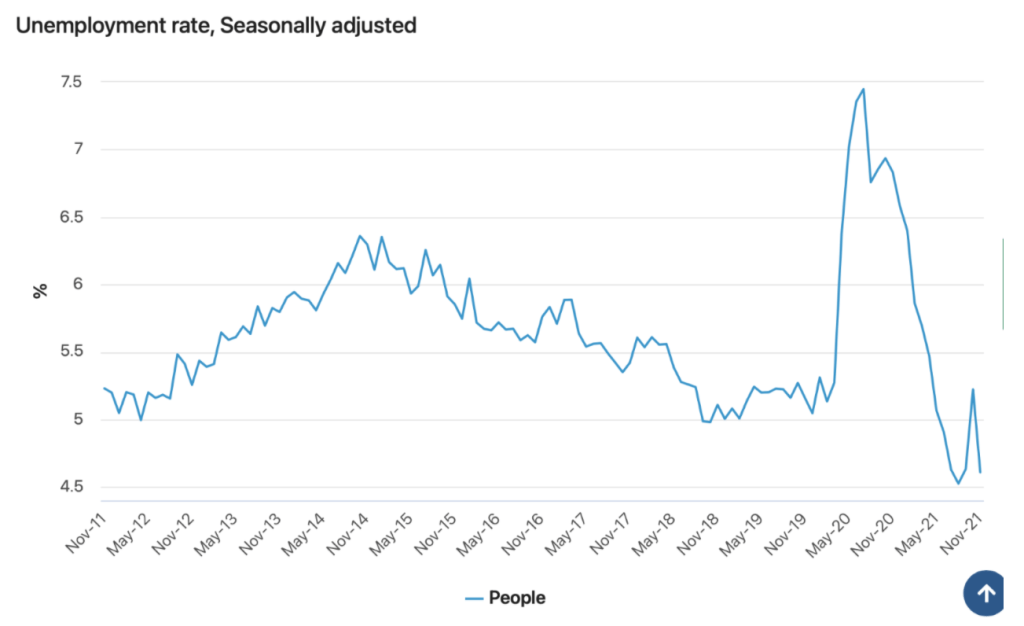

Then there’s employment. Jobs equal confidence because workers spending their wages keep our economy turning.

ABS data to the end of November 2021 showed our unemployment rate continues to track below long-term averages after taking a hit during the worst months of the pandemic.

There’s every reason to believe this will continue to tighten as businesses reopen and demand for labour rises.

There’s every reason to believe this will continue to tighten as businesses reopen and demand for labour rises.

In short, as pathways to post-pandemic recovery evolve, and free trade opens up across our oceans, I believe the confidence index will remain optimistic in 2022.

Border reopening

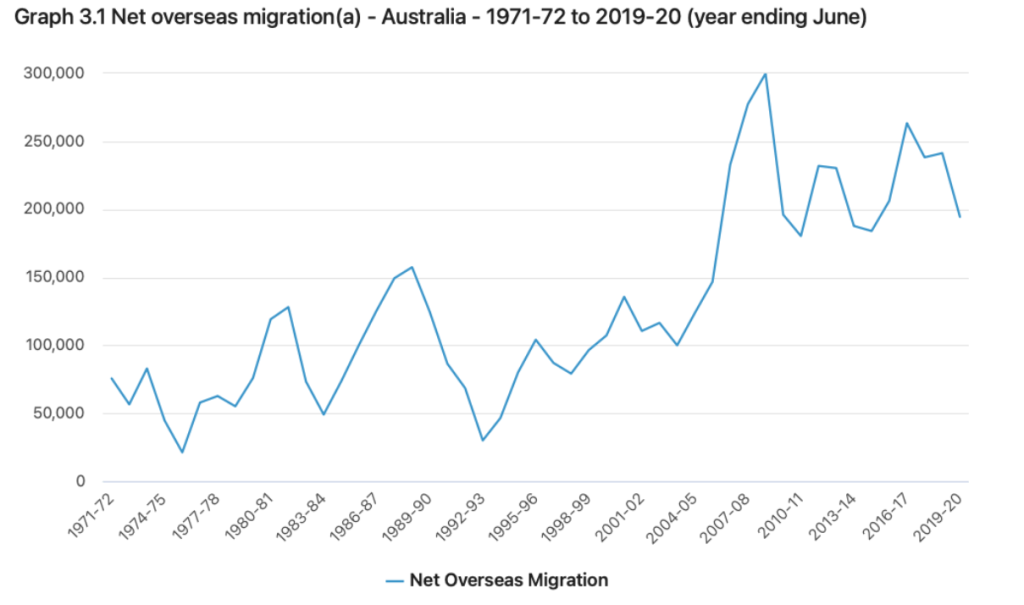

One huge driver of demand in the property sphere comes from those crossing borders – both interstate and overseas.

Of course, the boom gates were brought down on this cohort way back in early 2020. We no longer allowed offshore arrivals, so demand evaporated immediately. In addition, shutdowns had locked out some extraordinary sources of economic income – namely overseas students and labour.

Net Overseas Migration numbers for the financial year 2020/21 are yet released by the ABS, but numbers for the previous financial year showed the beginning of a significant downward trend.

Of course, these figures are dated as they include pre-pandemic level of immigration.

Of course, these figures are dated as they include pre-pandemic level of immigration.

But here’s the thing… those days appear to be over.

In December, Australia reopened borders to vaccinated skilled migrants and foreign students after nearly two years… and I’m expecting them to return in droves.

While we are currently at the rising end of infection, we’ve shown that Australia is just about the best place to be in a pandemic. Universal health care, a relatively low-density population, and a climate suited to COVID suppression. There’s no doubt many from across the waves are longing to resettle here – and they’ll need shelter.

According to a report by Reuters, foreign students deliver around $35 billion a year to the Australian economy. This cohort also fills many of our casual employment positions.

The gates have been fully reopened to returning Australian passport holders too. Expats – many cashed up and keen to come back – have been returning in droves. They have been behind some of the most impressive property purchases in recent memory as well, which has only bolstered domestic demand for ultra-luxe homes.

In fact, according to Domain, the Top 20 Sydney house sales for 2021 tally almost $700 million. That’s an average of $35 million apiece. Most telling about this sector is that Nine of the top 20 sales were sold with no marketing and public sales campaigns.

And this activity isn’t confined to Sydney, with capitals across the country seeing extraordinary money spent on flash housing.

So why should you care as an average-price investor? Because, historically, market gains are led from the top. Confidence in the prestige sector filters through, dragging up prices progressively. It’s a canary in the coalmine if you want to get the lead on potential growth markets.

Finance and Interest rates

Real estate is a game of finance. The free flow of credit makes it possible for homeowners and investors to contribute capital to the property market. Open the faucet of lending, and activity in the sector ramps up. Conversely, when the tap is shut off, watch the rivers run dry on capital gains and cashflow.

The greatest modern-day example of this was in 2017 when APRA looked to cool investor lending via a combination of mechanisms. Banks tightened their lending criteria and, as it got tougher to borrow, property prices attenuated.

Of course, the pandemic saw plenty of financial relief in this space. Apart from assistance delivered by government via grants such as HomeBuilder and access to Superannuation, buyers also boosted their deposits through savings.

Banks also helped with mortgage repayment holidays, more relaxed lending options and flexible responses to those struggling.

And then there were continued record low interest rates. The current cash rate sits at 0.10 per cent.

With all this in mind, what do I expect will unfold this year in finance?

Well – lending criteria might toughen up again for investors. APRA signposted their intentions in October 2021 by increasing the lending buffer by 0.5 percentage points to 3.0 per cent. So, for example, if you are applying a loan with an interest rate of 2.0 per cent, the application will be assessed as if you are making repayments based on 5.0 per cent.

The recent inflation uptick, increasing business confidence and runaway house prices have the RBA make noises about rate rises and some economists are predicting an increase in late 2022.

My thoughts are that while lending is a problem, it can be managed for clients via sound advice from the right professionals. Don’t expect a rise in rates to cut the market off at the knees.

Besides, most smart borrowers will have factor increased interest rates into their arrangements and can bear a rate hike without the need to offload assets, so a mass sell down in the market is unlikely.

2022 investor challenges

There are three key hurdles you’ll need to clear as part of your property portfolio’s success this year.

1 – Locating good stock

While I remain bullish about markets in 2022, they will be far less forgiving than they were in 2021.

Last year just about every property, regardless of location, saw its value rise. Of course, selecting ideal assets meant you would have enjoyed above-average gains, but even poorer-quality investments did OK during the boom.

But in 2022, choosing the right asset will be crucial.

There’s a wealth of opportunity to select the correct location, property type and price point this year. By the same measure, there’ll be plenty of chances to lose money if you don’t rely on sound metrics and advice.

2 – Time

While we all struggled with shutdowns, there is one gift we were given by 2020 and 2021 – and that was time. There was opportunity for us to reflect on what was important, and plan for our futures.

In 2022, I expect things to be a bit different. The pace of life will be more hectic. Unfortunately, this can see investors cut corners when analysing their options.

In addition, high-quality stock will be sought after by borderless investors Australia wide. You will be wanting to stay ahead of the pack – and that means finding and securing deals before others. It’s a big country, so analysing the hundreds of property markets on offer to choose the best options will be tough.

The best way to overcome this is to outsource the hard work to professionals.

3 – Agility

Yes, there is more confidence heading into this year about rebuilding of our social, professional and personal lives. However, as we’ve learned (particularly during the past two months) we’re still having to adapt quickly to our ever-changing landscape.

I think those that are flexible and adaptable are set to thrive in 2022. Being agile will serve investors well, so they can see what’s occurring and make choices that will reduce risks and improve outcomes.

You must also ensure you’re constantly monitoring your resources and portfolio performance so you can respond to change accordingly and make quick, sure-footed decisions as needed.

In summary, I remain cautiously optimistic about Aussie property markets in 2022.

I believe there will be golden opportunities for investors to acquire exceptional assets this year. The sorts of properties that can establish portfolios and build financial security for years to come.

With that said, choosing the right properties will be more challenging than ever, and the risk of going down the wrong path is much greater than it was last year.

2022 can be your year to thrive in real estate investment. Just ensure you rely on the right advice from experts in the know.

Book an appointment with our passionate property mentors today.

Disclaimer: This is general advice and has been prepared without taking into account your particular situation or needs. You should consider whether it is appropriate for you before acting on it.